CONSTRUCTION FORMS, INC. (CFI) ANNOUNCES ACQUISITION OF TRICON WEAR SOLUTIONS AND INCREASES PORTFOLIO OFFERING FOR DEMANDING INDUSTRIAL APPLICATIONS

LINCOLNSHIRE, ILLINOIS, July 24, 2023 — Construction Forms, Inc. (“CFI”), a portfolio company of H.I.G. Capital (“H.I.G.”), announced the acquisition of Tricon Wear Solutions (“Tricon”). Tricon is a leading manufacturer of abrasion, wear-resistant products, specializing in highly engineered steel plates and other fabricated products. The acquisition will broaden CFI’s expertise and offerings in abrasion resistant products for demanding industrial applications.

“Together, Tricon and CFI will be a stronger, more diversified partner to new and existing customers, globally with an expanded offering and strengthened value proposition,” says Stefan Brosick, CEO of CFI.

Tricon will operate under the CFI umbrella together with Con Forms, Ultra Tech, and Esser Twin Pipes, and will share in the benefits of their global presence. The CFI group of businesses will benefit from the years of expertise that Tricon has developed in pulp and paper, mining, and other industrial segments.

Todd Plate, President and CEO of Tricon, commented, “Both companies have a shared vision of relentless focus on customer needs and safety. Together, we have decades of expertise in engineering solutions for challenging abrasion and wear resistance applications. Our partnership with CFI creates an expanded platform to serve customers in the most severe wear situations worldwide.”

“We are excited to welcome the exceptional Tricon team” says Brosick. “CFI’s expanded portfolio will increase the breadth of superior aftermarket solutions, all focused on delivering the lowest total cost of ownership for our customers.”

John Von Bargen, Managing Director at H.I.G., added, “CFI’s partnership with Tricon is a transformative merger that creates a diversified leader in the industrial wear parts market. This is the first of what we hope will be several acquisitions further building upon CFI’s platform of leading wear parts companies.”

Combined, the CFI group of companies will have more than 350 employees with five U.S.-based manufacturing facilities and one in Europe. CFI serves customers globally in a wide range of industries including concrete pumping, mining, dredging, power generation, and pulp & paper.

##

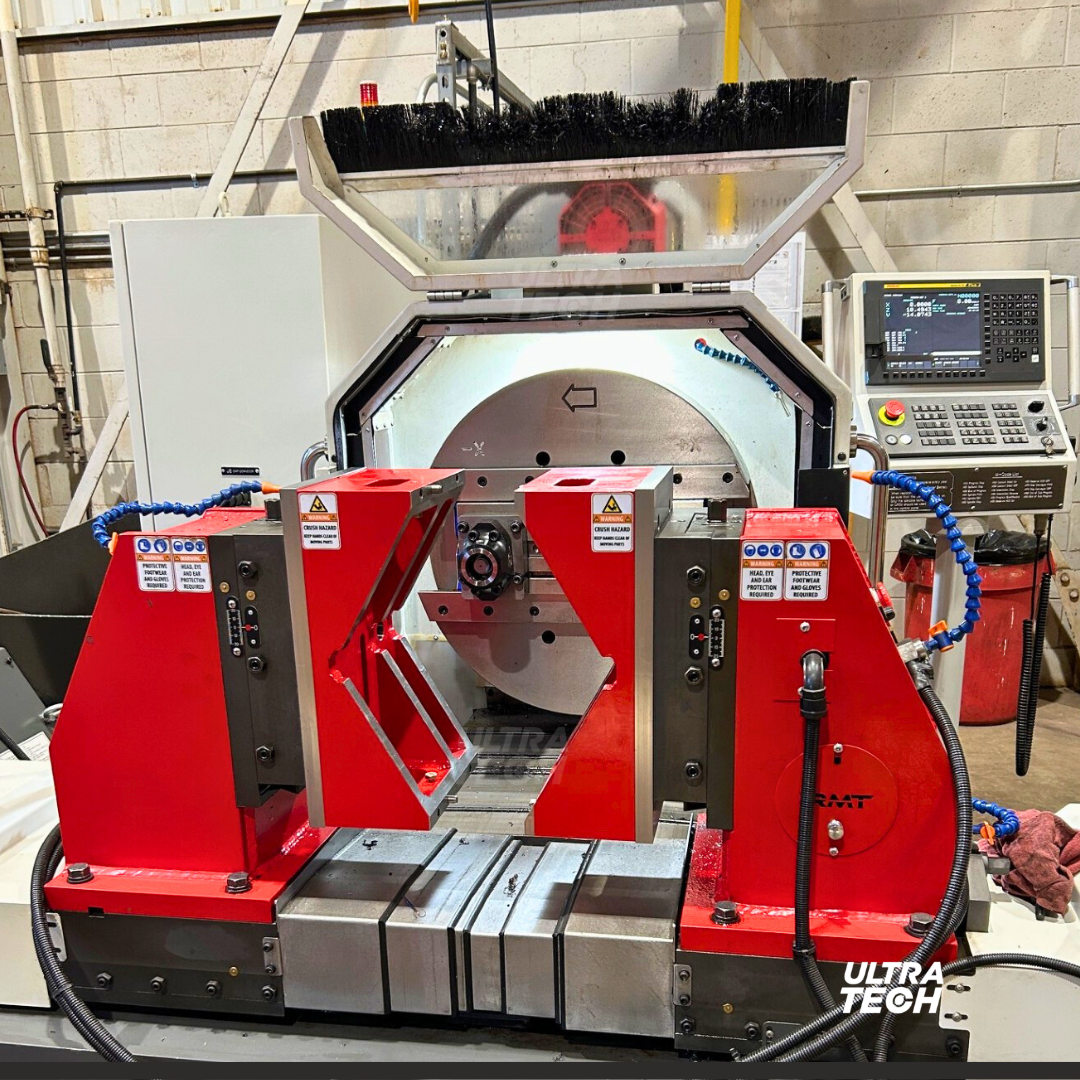

About CFI: For over 70 years, CFI companies have been recognized as trusted global partners and manufacturers of best-in-class products for the world’s most challenging industrial applications. Con Forms is the leading expert in concrete delivery systems and components. Ultra Tech is a global leader in the design, manufacture, and service of safe, induction-hardened, abrasion-resistant piping systems and accessories. Esser Twin Pipes continues to develop their industry-leading twin-wall piping systems ideal for many specialized industrial applications. Con Forms and Ultra Tech manufacture in Port Washington, Wisconsin, and Esser Twin Pipes operates in Warstein, Germany. For more information, please visit CFIcompany.com.

About Tricon Wear Solutions: Headquartered in Birmingham, Alabama, with additional facilities in Nevada and Illinois, Tricon is a leading manufacturer of abrasion, wear-resistant products, specializing in highly engineered steel plates and other fabricated products. Tricon serves customers across various end markets including pulp & paper, mining, and aggregates with its leading metallurgy, fabrication, and engineering capabilities. For more information, please visit https://www.triconwearsolutions.com/.

About H.I.G. Capital: H.I.G. Capital is a leading global alternative investment firm with $57 billion of capital under management.* Based in Miami, and with offices in New York, Boston, Chicago, Dallas, Los Angeles, San Francisco, and Atlanta in the U.S., as well as international affiliate offices in London, Hamburg, Madrid, Milan, Paris, Bogotá, Rio de Janeiro and São Paulo, H.I.G. specializes in providing both debt and equity capital to small and mid-sized companies, utilizing a flexible and operationally focused/ value-added approach:

- H.I.G.’s equity funds invest in management buyouts, recapitalizations and corporate carve-outs of both profitable as well as underperforming manufacturing and service businesses.

- H.I.G.’s debt funds invest in senior, unitranche and junior debt financing to companies across the size spectrum, both on a primary (direct origination) basis, as well as in the secondary markets. H.I.G. also manages a publicly traded BDC, WhiteHorse Finance.

- H.I.G.’s real estate funds invest in value-added properties, which can benefit from improved asset management practices.

- H.I.G. Infrastructure focuses on making value-add and core plus investments in the infrastructure sector.

Since its founding in 1993, H.I.G. has invested in and managed more than 400 companies worldwide. The firm’s current portfolio includes more than 100 companies with combined sales in excess of $52 billion. For more information, please refer to the H.I.G. website at www.higcapital.com.

* Based on total capital raised by H.I.G. Capital and its affiliates.